Consumer confidence levels in Egypt fell dramatically in the third quarter to a 10-year low, according to the latest consumer confidence report from Nielsen. The Nielsen Consumer Confidence Index recorded a score of 70 for Egypt, 29 points below the global average of 99 and the country’s lowest Consumer Confidence Index score recorded by Nielsen in the 10 years the company has been tracking Egypt.

Consumers’ outlook on job prospects was a major contributor to declining confidence; just one quarter of Egyptians (25%) feel favorable about job prospects in Egypt over the next twelve months, a drop of six percentage points from the previous quarter. The number of consumers feeling positive about their personal financial outlook declined seven percentage points to 42% quarter-on-quarter, while the proportion of consumers who believe the coming 12 months will be a good time to buy the things they need and want decreased eight percentage points to 23% from the second quarter.

More than one in five Egyptians (22%) site the economy as their biggest concern over the next 12 months, followed by job security (13%). The majority of Egyptians (81%) believe Egypt is in an economic recession at the moment. Nearly three in four (72%) have changed their spending patterns in order to save on household expenses and 36% are channeling their spare cash into savings accounts.

“In Egypt, local currency devaluation against the dollar were at a record low, and the cost of living is increasing across the board,” said Tamer ElAraby, Managing Director, Nielsen North Africa and Levant. “Amid the current situation, consumer confidence in the economy has declined by double digits in the third quarter. Steps are underway to secure a bailout from the International Monetary Fund to ease the current situation and to increase supplies of basic goods over the coming months. Depending on multiple economic corrections due to take place, we hope to see a more optimistic sentiment in the next quarter.”

- Advertisement -

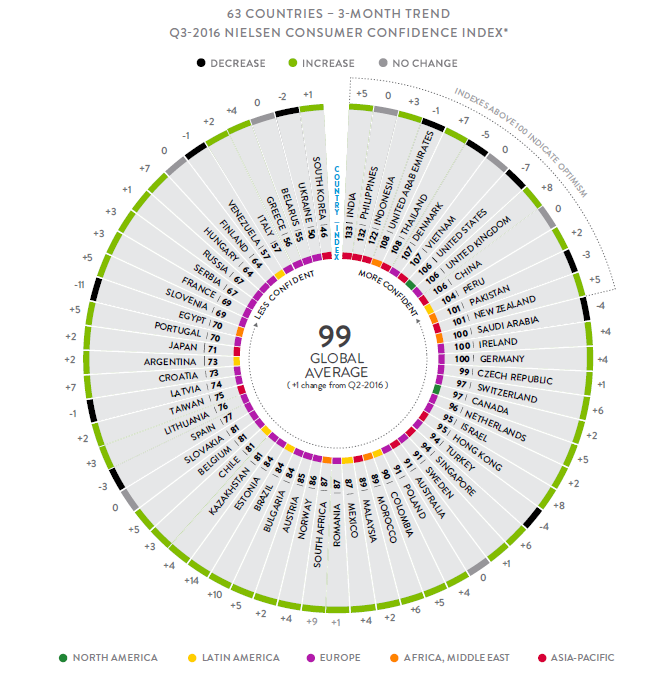

Established in 2005, the Nielsen Consumer Confidence Index is fielded quarterly in 63 countries to measure the perceptions of local job prospects, personal finances, immediate spending intentions and related economic issues of real consumers around the world. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism, respectively.

GLOBAL CONSUMER CONFIDENCE SCORES REFLECT ECONOMIC DIVERSITY AROUND THE WORLD

These are uncertain times and third quarter Nielsen Consumer Confidence Index scores varied dramatically region to region, demonstrating considerable economic diversity around the world. In Asia-Pacific, consumer confidence scores ranged from a high of 133 to a low of 46, with similar divergent scores in Europe (from 107 to 50), Latin America (from 104 to 57) and Africa/Middle East (from 108 to 70). In North America, however, confidence scores were more closely aligned in the U.S. (106) and Canada (97).

Notable global highlights include:

Global consumer confidence increased one point from the second quarter to a score of 99.

Confidence gains were seen throughout most measured markets in Asia-Pacific, Latin America and Europe. Meanwhile, confidence decreased in four of six Africa/Middle East markets and in one of two North American markets.

– Five of the world’s top 10 economies posted optimistic scores of 100 or higher: U.S. (106), China (106), U.K. (106), Germany (100) and India (133).

– Concerns about terrorism increased across Europe, North America and Asia-Pacific in the third quarter.In Europe, consumer confidence improved in 26 of 34 measured markets from the second quarter. The U.K.’s score increased eight points.

– In Asia-Pacific, confidence increased in 10 of 14 countries, while four markets were flat from the second quarter. Robust improvements came from Hong Kong, Thailand and Singapore.

– In Latin America, confidence increased in six of seven markets, including Brazil, which posted its first upswing in two years.

– In the Africa/Middle East region, South Africa posted a solid confidence increase of nine points.

Confidence DECLINED IN FOUR OF SIX AFRICA/MIDDLES EAST MARKETS

In the six Africa/Middle East countries measured, confidence scores ranged from a high of 108 in the United Arab Emirates (a one-point decrease from the second quarter) to a low of 70 in Egypt (an 11-point decrease). Pakistan (101) and Saudi Arabia (100) posted confidence scores at or just above the optimism baseline despite declines of three and four points, respectively, from the second quarter. The most robust confidence increase in the region came from South Africa with a nine-point rise to 87. Morocco’s confidence also increased, rising six points to 89 in the third quarter.

To download the full report, please visit LINK

ABOUT THE NIELSEN GLOBAL SURVEY OF CONSUMER CONFIDENCE AND SPENDING INTENTIONS

The third-quarter online survey was conducted Aug. 10–Sept. 2, 2016. The findings in this survey are based on an online methodology in 63 countries. While an online survey methodology allows for tremendous scale and global reach, it provides a perspective only on the habits of existing internet users, not total populations. In developing markets where online penetration is still growing, audiences may be younger and more affluent than the general population of that country. Three sub-Saharan African countries (Ghana, Kenya and Nigeria) utilize a mobile survey methodology and are not included in the global or Middle East/Africa averages discussed throughout this report. In addition, survey responses are based on claimed behavior, rather than actual metered data. Cultural differences in reporting sentiment are likely factors in the measurement of economic outlook across countries. The reported results do not attempt to control or correct for these differences; therefore, caution should be exercised when comparing across countries and regions, particularly across regional boundaries.