[dropcap style=”2″ color=”#f50a0a” text=”A”]t its annual Google I/O developer conference in San Francisco, Google announces e-mail money transfers for Google Wallet.According to the Google Wallet site, US users who are 18 years and older will be the first beneficiaries of the feature which will roll out within a couple of months.

And Google Wallet, first announced two years ago, has struggled to get wireless carriers and phone manufacturers to install what is called near-field communication technology. NFC technology is what would make it possible for certain Android users to wave their phone at a retailer’s receiver to make a payment.

Also Read : PayPal Officially in Egypt

But now, Google has announced that it will allow Gmail users to attach money to emails, just as they would a photo or a document, as shown in the video. The move could radically transform the way we exchange money with friends, family and even businesses.

- Advertisement -

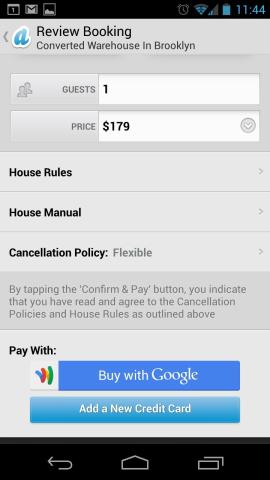

In a nutshell, consumers can purchase things from an app or online store with just a couple of clicks. The company and one of its initial Instant Buy partners, Priceline, showed off how easy this process can be during a demonstration at a Google developer session here today.

The way to think of it is a more streamlined PayPal button for Google users. Google has already signed up several partners including Airbnb, Booking.com, Uber, and Expedia, who will all integrate the functionality into their apps.

Google claims that the new functionality not only makes it easier for consumers to complete their purchases, but it’s also more secure. How? The merchants themselves never get access to the full the full credit card number, which means that sensitive account information isn’t stored on multiple merchant Websites.

According to the Google Wallet site, US users who are 18 years and older will be the first beneficiaries of the feature which will roll out within a couple of months. Users who link their bank accounts to Google Wallet receive transactions for free. Those using debit or credit cards pay a 2.9% transaction fee, and transactions are limited to $10,000.